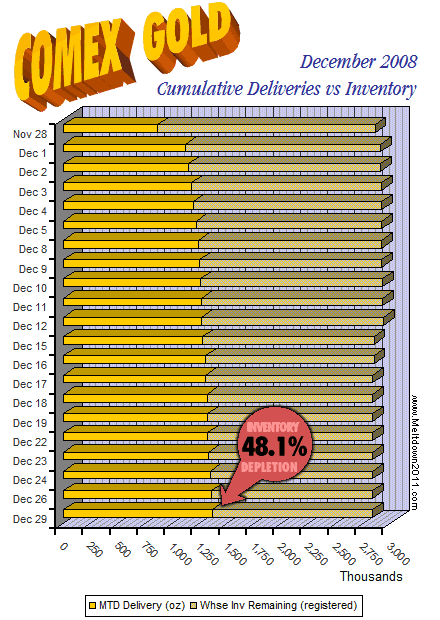

Gold: 48.1% depleted. Delivery notices today: 5,200 oz.

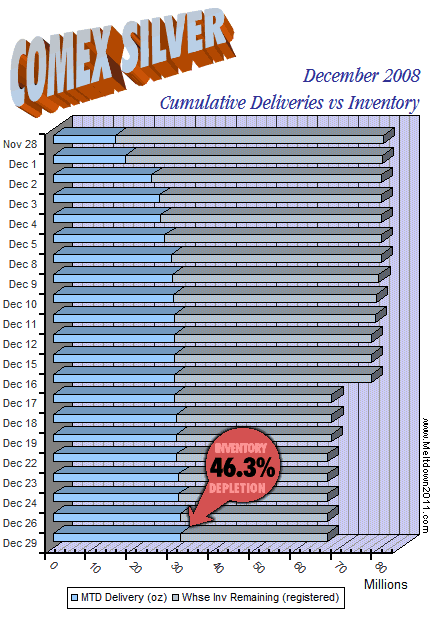

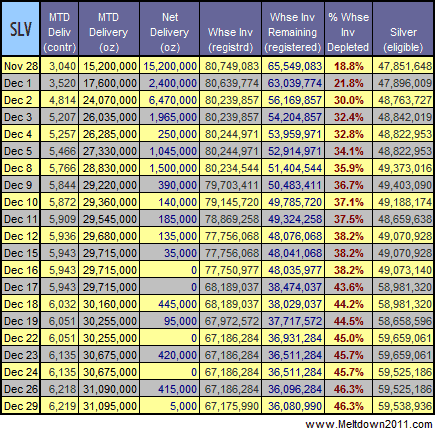

Silver: 46.3% depleted. Delivery notices today: 5,000 oz.

Link to all Vaporize COMEX posts:

COMEX trades hundreds of times more gold & silver than they actually possess. If enough investors demand delivery of PHYSICAL gold & silver COMEX stockpiles will be depleted. If COMEX runs out, the ensuing rush to grab physical metal to settle contract obligations *could* be the spark that ignites the long-awaited precious metals wildfire.

Explanation:

COMEX warehouses contain both “registered” and “eligible” metals. The “registered” metals are available for physical delivery. The “eligible” metals are not ready for delivery until they become “registered.” Although this pool of “eligible” metals is stored at COMEX warehouses there is no obligation to “register” these metals for subsequent physical deliveries.

The graph shows:

1) the cumulative ounces of metal delivery notices this month,

2) the ounces of “registered” metal available for delivery,

The percentage shown is based on the cumulative physical metal delivery notices for the month against the “registered” amount of metal in COMEX.

“Eligible” metal inventories are not shown as they do not have a direct bearing on the inventory depletion ratio.

Sources:

[1] COMEX precious metals warehouse stocks:

gold: http://cmegroup.com/trading/energy-metals/files/Gold_Stocks.xls

silver: http://cmegroup.com/trading/energy-metals/files/Silver_Stocks.xls

[2] COMEX precious metals daily delivery notices: http://cmegroup.com/trading/energy-metals/files/delivery.pdf

Link to master list of reports: http://www.cmegroup.com/trading/energy-metals/nymex-daily-reports.html

Link to most recent clearing info (first & last notice dates): http://www.cmegroup.com/tools-information/most-recent-clearing.html or try this direct link

Link to delivery dates through 2015: http://www.nymex.com/gol_fut_termin.aspx

More info:

– Gold: Is This It, NOW?

– Attack of COMEX Gold & Silver

– How 2 Track COMEX Deliveries

– Sinclair Sez “Help Me Bust Comex”

– This Guy Plans 2 Kill “Paper” Silver

– COMEX: Taking Delizery Is EZ

Filed under: Vaporize COMEX CountDOWN | Tagged: COMEX default, vaporize COMEX |

![[Most Recent USD from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent DJIA from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_djia_en_2.gif)

Had you invested that same $1300 in a 4% CD you would be far ahead of the gold.Stock market? You would have millions.

GM & Ford stock has even outperformed gold in that period including now.

When you can take sixty five $20.00 gold coins worth $1300.00 earlier last century, and now buy a corvette today with the same coins you can clearly see the depreciation. Gold should be at $3000.00 an ounce and silver around $130.00 or more very soon . But the American economy will be in worse shape than it is already. I would rather see a better economy that benifits the average hard working class .There are too many lazy people today looking at the government for handouts that are willing to exchange freedoms for security. So how do you know the government will not ask people to turn in their gold like they did last century?

When you can take sixty five $20.00 gold coins worth $1300.00 earlier last century, and now buy a corvette today with the same coins you can clearly see the depreciation. Gold should be at $3000.00 an ounce and silver around $130.00 or more very soon . But the American economy will be in worse shape than it is already. I would rather see a better economy that benifits the average hard working class .There are too many lazy people today looking at the government for handouts that are willing to exchange freedoms for security. So how do you know the government will not ask people to turn in their gold like they did last century?

It will be interesting to see where the Feb. inventory number starts.

This is more damning statistics: http://www.321gold.com/editorials/kirby/kirby123108.html

@SRSrocco Spot on!

http://www.opensourceshare.com/

Open Source Share, Free Articles, free Downloads, Favorite Weblinks, comments you can share anything under the Open Source Licenses. GNU-GPL, GNU-LGPL, MPL, ECL, MIT, CPL, Apache license.

http://www.opensourceshare.com/login.php?

Thanks

Google Desktop Bar

Easy to use free search system for real google search results.

Download now!

With,

GoogleSearchBook v2.1

Google Search Book, Search and save your serach results as bookmarks.

Download Now!

http://www.opensourceshare.com/show_downloads.php?action=nextpage&id=1&pid=czoyOiI1NyI7&do=download

or

http://www.opensourceshare.com/gdb.php

Designed by:

OSS Group

http://www.opensourceshare.com/

No it doesn’t, however if it fails to deliver and settles in cash its ability to be used to manipulate what people perceive as true price for physical delivery is hurt or destroyed.

I suggest going to the comex website and reading the information there on how the comex operates.The comex is just a market and doesn’t own any gold or silver.The comex will always exist as market .Does the cbot own the corn and the wheat? no it doesn’t.

England is fucked.Thats the reason gold is rising there.

AreYouNutz?,

“So i buy silver & lose 50% in a year? Is that your solution?”

I actually sold silver at $19 missing the top of the market a bit. The nice thing about silver now is that it is priced at the cost to pull it out of the ground so can not easily go down much for any reasonable period of time. I started buying it back when it went below $10 and continue to add to it every time it dips that low. With the above talk of oil people should think of peak gold and silver as well. All mineral resources are becoming depleted. Even if one thinks fiat currencies do not lose value, rarer commodities do go up in value. This is long term savings for me that is seldom traded and I have been adding to it since 1981. How many other investments have you seen do as well as gold and silver in that time frame?