Eric Roseman shares his wisdom on the recent stock market rally. As I said a few weeks back [Bottom? NO Rally? YES] this is a head-fake rally: a chance to bail out of destroyed 401(k)s at an interim top. The markets haven’t really calmed down until the Fear Index (VIX) settles back to the 10 to 20 range.

Eric Roseman shares his wisdom on the recent stock market rally. As I said a few weeks back [Bottom? NO Rally? YES] this is a head-fake rally: a chance to bail out of destroyed 401(k)s at an interim top. The markets haven’t really calmed down until the Fear Index (VIX) settles back to the 10 to 20 range.

There is so much you’re not being told about the economy. With the bailout at $7,224,000,000,000+ and GE technically bankrupt (YES, that GE) with their huge earnings bomb THINGS ARE NOT NORMAL. This is just a quiescent period before the “Summer From Hell” and a “Fall From Grace.”

Please consider this man’s words carefully.

![]()

Stock Market Rally for Suckers as Credit Destruction Lingers

Since March 9 stocks have been enjoying a period of strong gains, low relative downside volatility and rising inflows into stock mutual funds. From their lows four weeks ago, stocks are now up a cumulative 24.5%.

Since March 9 stocks have been enjoying a period of strong gains, low relative downside volatility and rising inflows into stock mutual funds. From their lows four weeks ago, stocks are now up a cumulative 24.5%.

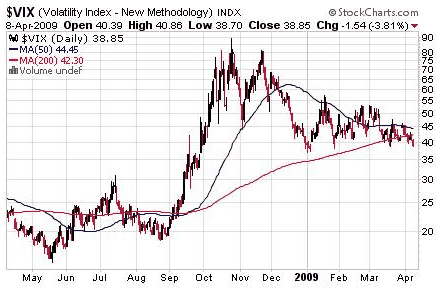

Indeed, the Volatility Index (VIX) continues to decline since hitting an all-time high last November.

The VIX, which measures options trading sentiment on the S&P 500 Index has crashed from a high of 80.86 to 38.85 ahead of today’s trading, a 52% decline. If the VIX closes today below 38.50 – highly probable — then I’d view that as a bullish signal for the short-term direction of the markets.

Stocks Still Propelling Higher?

The stock market is now crossing important territory this month as first quarter corporate earnings begin in earnest. With the FASB engineering a hocus-pocus act on bank earnings last week the market is expected to get a boost from the new trend in phony financial services accounting. This will give the market an additional boost this month.

Combined with better earnings guidance from companies, which I view as almost impossible in this environment, might be enough to propel stocks even higher.

A key index level to watch for a new break-out is Dow 9,015.10 and the Dow Transports at 3,717.26; if these indices break through these important resistance levels then my intermediate and long-term bearish view on stocks will be violated. Until we crack these thresholds, this is still a bear market rally.

This Is Not a “Normal” Cyclical Economic Recovery

The stock market is largely manipulated by sleuths whereas the bond market is largely dominated by the “smart” money. And the credit indicators tell me that we’re a long way from bottoming in this credit cycle – especially in several markets that are not currently assisted by the Fed and Treasury. Basically, high quality credit spreads have not narrowed since the commencement of this stock rally. This is bearish price action.

First Time In a Lifetime

I’ve never experienced a debt deflation. Nor have most people currently alive. It is unwise and foolish to treat this bear market like any other in the post-WW II period because it is totally unique; the scope and depth of the ongoing destruction of consumer and business credit, bank balance sheet compression and insolvency, consumer retrenchment and soaring unemployment should not be underestimated. The rare nature of this recession precludes a cyclically normal U.S. recovery.

This is a time for investors to largely preserve capital and wait for the market environment to improve as it pertains to government regulation and the future of our banking system. Many questions are still unanswered or unresolved.

Gold To Regain Footing

But the bulk of your assets should be targeting high quality short-term investment grade debt, convertible bonds, TIPS, mortgage agency debt, senior Canadian bank debt and, once the dollar finally pops, foreign currency bonds. Also, I have no doubt that gold will eventually regain its footing and head through the roof once deflation is quashed. We’re all going to pay dearly for this monster-sized spending – clearly out of control at this point.

Drug Addict Needs Another Fix Soon

In the 1930s the Dow posted several major bear market rallies before finally bottoming in June 1932. The current rally – now the third such period of gains since early 2008 – has room to advance because of the massive amount of concerted global fiscal spending now hitting the financial system and eventually, the real economy. But like a drug addict that needs his fix this recovery will require another dose of spending in 2010 as government stimulus fails to supplant consumer spending indefinitely. The consumer will not save the day as he remains focused on balance sheet repair and cash savings.

In the absence of a global consumer now that the United States is raising its savings rate, there isn’t one nation that can supplement U.S. imports. This implies major hurdles for the global economy and therefore corporate earnings as we look beyond a blip in economic activity the second half of 2009.

This bear should not be underestimated. The destruction of credit and wealth has not passed its peak but rather is taking a time-out before feasting again on the financial system perhaps later this year or in 2010. [more]

More of interest:

Bottom? NO Rally? YES

Filed under: Markets & Economy | Tagged: roseman, VIX | 1 Comment »

![[Most Recent USD from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent DJIA from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_djia_en_2.gif)