Jim Sinclair and George Green are saying the collapse of Lehman Bros may be “the Big One” that leads to the entire collapse of our financial system. Eric Roseman, chief financial advisor for The Sovereign Society, sums yesterday up this way:

“What a horrendous day. Black Monday was just awful for investors. And that’s after Treasury Secretary Hank Paulson called the day’s trading “orderly” considering the bankruptcy of Lehman Brothers Holding on Sunday night. Orderly it wasn’t.

“The S&P 500 and the Dow posted their third-worst point declines in history on Monday and are now down more than 23% from their October 2007 all-time highs. The MSCI World Index is now down more than 25% off its high, and the MSCI Emerging Markets Index sits just south of a 40% crash from its peak. Ugly indeed.

“Any way you slice and dice it, this is serious bear market territory. We have to go back to 1974 to find similar percentage declines and financial market carnage.

“In some ways, this crisis is worse and more on par with the 1930s. It’s definitely a fair comparison as central banks, mainly the Fed, launch an all-out assault on falling prices.”

So, is Lehman’s collapse “the Big One”?

Not in my book. I no longer believe there will be a “Big One”, a mighty one-day, double-digit drop in worldwide markets. I say this, in part, because of Treasury Secretary Paulson’s comments yesterday. He called the day’s trading “orderly.”

Orderly.

Bush had to come out at 11:00 to calm the markets after the government finally decided to let one of the crooked banks fail. Paulson sees this as “orderly.”

PPT

I believe he believes it, too. I believe he thinks it’s “orderly” because it’s all going according to plan. We know he heads up the PPT (the gov’t’s Plunge Protection Team). The PPT has been given broad authority to manipulate markets. They have access to a pool of Fed funds they then dole out to their favored banks (JP Morgan Chase is one) who enter the markets to manipulate the indexes through rigged buying/selling.

The PPT/JP Morgan tag-team is behind the ongoing smackdown of gold & silver as well. This is done, in part, to prop up the US dollar.

This is why the avalanche of complaining to the CFTC about gold/silver manipulation, and to the SEC about naked short selling, is completely ignored.

The activities of the PPT are completely illegal.

The activities of the PPT went into full swing last summer when the OTC derivitives / credit crisis first reared its ugly snout.

The activities of the PPT are ongoing.

Our markets and precious metals pricing are so manipulated I don’t believe a massive, one-day collapse would be allowed to happen. For over a year now they have carefully managed the slow-motion collapse of the stock market and dollar.

See how they defended the dollar every 2.5 pts down, just like clockwork?

See how the DJIA 24% drop in the last year is hidden behind a smokescreen of false rallies?

Why would they stop this slow motion collapse? They won’t.

The Plan

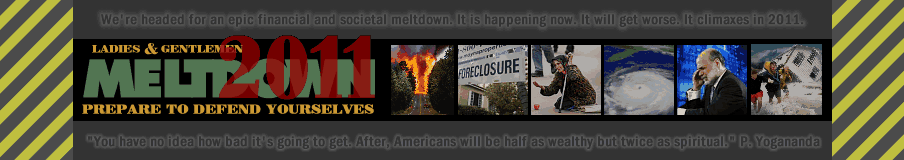

They don’t want a collapse. They want a meltdown. A collapse would lead to panic. They can’t control panic. A slow-motion meltdown minimizes panic among the common public. It buys the crooks-in-charge time to move/reallocate their assets to safer havens. It buys them time to stick the mess with an unsuspecting public (you and me).

My Prediction

Back in February I laid out some predictions [link].

I said the all-time high in the stock market already occurred Oct 11, 2007 at 14,279. With the market now at 10,866 this is exaclty how it’s playing out. I say it’ll drop another 50% or so to 5,711 by 2011.

I said Fannie Mae, Freddie Mac, Morgan Stanley and Bear Stearns, and other major financial institutions, would be crippled by the implosion of OTC derivatives in 2008. Bear Stearns, Fannie and Freddie are all belly up, their corpses rotting in the summer heat. Morgan Stanley is still alive and trying to help the PPT with AIG, but their stock is down 60% in the last year. Ouch.

I said the FDIC would go bust attempting to insure angry depositors. The FDIC is now asking congress for more money as their reserves have dropped dramatically from $60 billion to ???? hmm, they aren’t really forthcoming with actual, believeable numbers.

I said the FDIC would go bust attempting to insure angry depositors. The FDIC is now asking congress for more money as their reserves have dropped dramatically from $60 billion to ???? hmm, they aren’t really forthcoming with actual, believeable numbers.

But with banks failing every-other Friday and Washington Mutual starting to stink up the office like a dead rat that fell in the toilet, the FDIC is in big trouble.

So, Secretary Paulson is probably pretty pleased with how the slow-motion meltdown is proceeding. It is, in his mind, quite “orderly.”

And I think we’ll see the markets defended briefly at each major crossing (11,000, 10,000, 9,000 etc.) but the trend will always be down. Same for the dollar. The PPT stepped in at 70 and have gotten a brief rally back to 80, but it’ll soon slide back below 70 and be defended every 2.5 pts down to its ultimate bottom of 52. Then, as Jim Sinclair says, they’ll step in and reset the US currency value in relation to gold.

So…. was yesterday the Big Event? Nope, that happened last summer when the credit market froze. It’s all been downhill since, and it’ll stay that way for at least another 2 years.

◊◊◊◊ Now: Gold @ $777.70, Silver @ $10.58, USDX @ 79.18 ◊◊◊◊

◊◊◊◊ Now: DJIA 10,904.16

Filed under: > Scott's Soapbox, Conspiracy, Markets & Economy, Silver & Gold | Tagged: Plunge Protection Team | Leave a comment »

![[Most Recent USD from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent DJIA from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_djia_en_2.gif)