Sure, you’ve got some things lining up for the second phase of the Meltdown. For your consideration:

1) FDIC has run out of money so they’ve stopped closing banks they’d otherwise have to bail out. Ominous, as this strategy is not sustainable. [link]

2) CITI bank has lost $8,000,000,000 in their credit card business this year and are on life support. They suddenly shut off a bunch of gas cards last week.

3) CIT is the major provider of financing for small/medium business in US. They’re on life support, too. When (not “if”) they go under they’ll take the major source of jobs in the US with them. B-A-D…

4) People taking delivery of gold futures contracts from Sept are now seeing 22K (.916 fine) bars delivered instead of the required 24K (.999 fine) bars. The gold ETF “GLD” is required to publish a list of all gold bar serial numbers each day. 85% of these bars have gone missing from the list. [link]

5) J.P.Morgan and Deutsche Bank have offered bribe money up to 125 percent of the quoted spot price to holders of Sept. long contracts if they would take settlement in paper, on condition that the embarrassing affair will be kept secret. [link] JPMorgan doesn’t have the gold they were selling short!

6) Jim Sinclair’s Dollar Death Countdown started at 150 days. It reaches zero in 3 weeks.

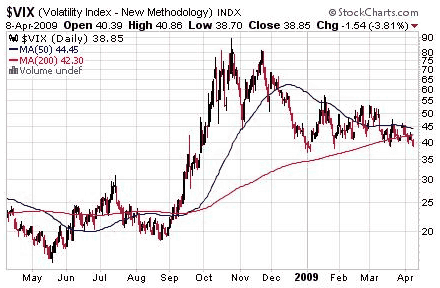

7) The VIX (aka “Fear Index”) is the lowest it’s been all year [link]. No one is expecting anything bad to happen.

7) The VIX (aka “Fear Index”) is the lowest it’s been all year [link]. No one is expecting anything bad to happen.

8) In the last month guess who’s announced plans for replacement currencies for the US dollar? China, Saudi Arabia, France, Japan, Russia, Brazil, India. The latest is Bolivia, Venezuela, Cuba, Ecuador, Nicaragua. [link]

9) George Ure and the Web Bot guys have been warning about a major event/turning point Oct. 25 +- 1 week with an 85/15 probability of being financial in nature.

The following snippet is from George Ure (one of the Web Bot guys). Note the mention of the “#1 market timer for 2008 by Hulbert’s Financial Digest.” Hulbert’s reviews hundreds of financial newsletters each year and is highly respected…

Coping: With the Bad Part of 2010

Had a most interesting conversation with Arch Crawford last night about what’s ahead, not only for the ugly part of this year’s market (wait a week or two and you won’t be saying “huh?”) but also about the really ugly part of 2010; which is you want to mark it down should show up sometime between late July and Early August of next year by his work.

Crawford has been writing a financial newsletter for about 32 years and was “ranked #1 market timer for the 2008 calendar year” by Hulbert’s Financial Digest. What’s interesting about Crawford’s work is that it’s an astrologically based report – although other cycles are considered, too – which makes it interesting when a person (like me) is trying to line up periods where multiple predictive systems are all pretty much saying the same thing.

Just as the predictive linguistics work is pointing to big market moves starting as early as late Sunday (Monday in Asian trading time) Crawford’s work shows there’s a rough patch there.

But more worrisome is his take on the mid-2010 period. “It’s about the worst we’ve ever seen,” he told me.

How bad is bad?

“Well, when something is worse than the Revolutionary War, World War I, the Great Depression, and World War II, that’s bad – it’s the worst I’ve seen the charts in over 200-years.

As he explains it, there’s Mars conjunction Saturn which will be in opposition to Jupiter conjucting Uranus all squaring Pluto.

Not that it means a hill of beans to me – I’ll take a GPS reading, thanks – but because of the Pluto is where it is mid summer of next year the biggie stuff out there is likely to be planetary in nature.

Interestingly, this also corresponds to the predictive linguistics work what has the big showdown basically between good guys and bad guys there; a time when the global mass of humans will be seeking revenge/change/retribution from the PTB.

If you were sketching out a kind of mid-range path between Crawford’s work, Cliff’s linguistics work, Robin Landry’s Elliott (and then some) and trying to sketch out a trading path, it might go something like this:

-

From late October till early/mid December, a good-sized market decline, perhaps testing the March ’09 market lows around Dow 6,627.

-

Right after the first of the year, I’d be expecting a whole new chorus of “Good times are just ahead” and the ‘gloves to come off’ in terms of government control, imposition of group-think, and once the mutated swine flu comes out of the Winter Games, then lots of clamping down of people’s freedom of movement.

-

During this period, I’d be looking for energy to ‘shoot the moon’ along with the precious metals – oh boy!

-

And then as the social order collides with the globalist agenda over July-August, I’d look for the markets to be as bad as at any time in 200-years.

Hard telling how it will all play out, but the predictive linguistics would seem to fit this pretty well (they tend to state the most dire of language) but when other systems of getting a bead on the future start to line up, as I explained to Peoplenomics subscribers last week, that’s when I start figuring out how to be as we say here in Texas ‘all in’.

Filed under: Markets & Economy, The Meltdown | 21 Comments »

Standard & Poor’s downgraded the creditworthiness of

Standard & Poor’s downgraded the creditworthiness of

Prediction one.

Prediction one.

Prediction three.

Prediction three.

Prediction six.

Prediction six.

There will be widespread tax collection issues, and a huge backlash against Federal and state bureaucrats who demand three-percent annual pay raises while private sector wages remain frozen or worse. In short, the “Tea Parties” of tomorrow will likely not be so restrained.

There will be widespread tax collection issues, and a huge backlash against Federal and state bureaucrats who demand three-percent annual pay raises while private sector wages remain frozen or worse. In short, the “Tea Parties” of tomorrow will likely not be so restrained. I ran into the taco yesterday during my afternoon jog. Actually, the taco high-fived me as I ran by.

I ran into the taco yesterday during my afternoon jog. Actually, the taco high-fived me as I ran by.  “I did okay for a few years trading stocks during the dot com phase,” Fran continued. “But I lost a bunch of money in 2000 when the market fell.

“I did okay for a few years trading stocks during the dot com phase,” Fran continued. “But I lost a bunch of money in 2000 when the market fell.

This sobering missive is from the excellent Daily Wealth newsletter. many of us count on our life insurance, either to support our family if we should die OR for emergency cash.

This sobering missive is from the excellent Daily Wealth newsletter. many of us count on our life insurance, either to support our family if we should die OR for emergency cash.  Many life insurance companies sell variable annuities and other guaranteed return products. These products guarantee the investor will receive either a minimum return… or the gain in the S&P 500… whichever one is larger.

Many life insurance companies sell variable annuities and other guaranteed return products. These products guarantee the investor will receive either a minimum return… or the gain in the S&P 500… whichever one is larger.  But variable annuities aren’t even the biggest problem. No one has quite caught on to the real issue yet…

But variable annuities aren’t even the biggest problem. No one has quite caught on to the real issue yet… Take

Take  Richard Maybury describes himself as “The 2,500-year old man,” referring to his deep study of history (economic & otherwise) and how it repeats today.

Richard Maybury describes himself as “The 2,500-year old man,” referring to his deep study of history (economic & otherwise) and how it repeats today.

![[Most Recent USD from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent DJIA from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_djia_en_2.gif)