If this doesn’t make you think–make you want to prepare–I don’t know what will. From “Big Jake” on SeekingAlpha, “The Worst Case Scenario (Someone Has to Say It)” [edited for length]

Since the economy began sliding downhill in late 2007, mainstream economic and market experts have consistently erred on the sunny side.

As late as June 2008, mainstream consensus held that the U.S. was heading for a “soft landing” and would avoid recession.

Several months later, the slump was acknowledged to have started in January 2008, but we were supposed to see renewed growth by mid-2009, with unemployment peaking in the eight-to-nine percent range. A quick “shovel-ready” stimulus bag was supposed to set us back on the road to prosperity.

In January, recovery projections were pushed forward to late 2009. Today, the consensus is for a mid-2010 recovery, with unemployment peaking at just over 10 percent. Clearly, the mainstream has struggled to catch up to reality for well over one year. What are the chances that they finally have it right this time?

In the interests of providing you with an alternate vision—something outside the mainstream—below are ten predictions for America through the year 2012. This is not boilerplate doom-saying. Rather, I am laying out in highly specific terms what will happen over the next three-odd years. Others have thrown around the term “Depression”, but I am going to tell you precisely what it means for you, your investments, and your community.

Prediction one.

Prediction one.

The twenty-five-year equities bubble pops in 2009: the S&P 500 will sink below 500. In a bid to stem the panic, the government will enforce periodic “stock market holidays”, and will vastly expand the scope of its short-selling prohibitions—eventually banning short-selling altogether.

Prediction two.

With public pension systems and tens of millions of 401k holders virtually wiped out—and with the Baby Boomers retiring en masse—there will be tremendous pressure on the government to get into the stock market in order to bid up prices.

With public pension systems and tens of millions of 401k holders virtually wiped out—and with the Baby Boomers retiring en masse—there will be tremendous pressure on the government to get into the stock market in order to bid up prices.

Therefore, sometime in 2010, the Federal Reserve will create and loan out hundreds of billions of fresh dollars to the usual well-connected suspects, instructing them to buy up stocks on the public’s behalf. This scheme will have a fancy but meaningless name—something like the “Taxpayer Assurance Equities Facility”. It will have no effect other than to serve as buyer of last resort for capitulating smart-money types who want to get out of stocks entirely.

Prediction three.

Prediction three.

Millions of new retirees—including white-collar people with high expectations for a Golden Retirement—will be left virtually penniless. Thousands will starve or freeze to death in their own homes. Hundreds of thousands will find themselves evicted and homeless, or will have to move in with their less-than-enthusiastic children. Already strained by the rising tide of the working-age unemployed, state and local welfare services will be overwhelmed, and by 2012 will have largely collapsed and ceased to function in many parts of the country.

P rediction four.

rediction four.

“Quantitative easing” will fail to restart previous patterns of lending and consumption. As the government sends out additional “rebate” checks and takes ever-more drastic measures to force banks to lend, hyperinflation could take hold. However, comprehensive debt relief via a devaluation of the dollar is even more likely. This would entail the government issuing one “new” dollar for some greater number of “old” dollars—thus reducing both debts and savings simultaneously.

Prediction five.

The government will stop pretending that it can finance continuous multi-trillion-dollar deficits on the private market. By late 2010, the sole buyers of new U.S. Treasury and agency bonds will be the Federal Reserve and a few derelict financial institutions under government control. This may or may not lead to hyperinflation. (See prediction four).

Prediction six.

Prediction six.

The government’s narrow unemployment figure (U3) will rise into the high teens by late 2010. The government’s broader unemployment figure (U6) will cease to be reported when it reaches 25 percent—it will simply be too embarrassing. Ultimately, one in three work-eligible Americans will be unemployed, underemployed, or never-employed (e.g. college grads permanently unable to find suitable work).

Prediction seven.

Prediction seven.

With their pension dreams squashed, and their salaries frozen or cut, police and other local government workers will turn to wholesale corruption in order to survive. America’s ideal of honest, courteous, and impartial cops, teachers, and small-time local functionaries will have come to an end.

Prediction eight.

Commercial overcapacity will strike with a vengeance. By 2012, thousands of enclosed malls, strip malls, unfinished residential developments, motels, truck stops, distribution centers, middle-of-nowhere resorts and casinos, and small-city airports across America will turn into dilapidated, unwanted, and dangerous ghost towns. With no economic incentive for their maintenance or repair, they will crumble into overgrown, plywood-and-sheet-rock ruins.

Prediction nine.

Prediction nine.

By the end of 2010, tens of millions of households will have fallen behind on their mortgages or stopped paying altogether. Many banks will be unable to process the massive volume of foreclosure paperwork, much less actually seize and resell the homes.

Devaluation (as mentioned in prediction four) could ease the situation for those mortgage holders still afloat, but it would also eliminate any incentive for most banks to stay in the mortgage business. In any case, the housing market in many parts of the country will lock up completely—nothing bought or sold.

With virtually no loans being made, even the government will finally acknowledge that most banks are fundamentally insolvent. A general bank run will only be averted through a roughly one trillion-dollar recapitalization of the FDIC, courtesy of new money from the Federal Reserve.

Prediction ten.

As an economy is never independent of the society within which it functions, the next few paragraphs will focus on social and political factors. These factors will have as much of an impact on market and consumer confidence as any developments in the financial sector.

Whether rightly or not, President Obama, having come to power at the dawn of this crisis, will be blamed for it by over 50 percent of the population. He will be a one-term president. In response to his perceived socialization of America, there will be a swarm of secessionist and extremist activity, much of it violent. Militias and armed sects will be more prominent than in the early 1990s. Stand-off dramas, violent score-settlings, and going-out-with-a-bang attacks by laid-off workers and bankrupted investors—already a national plague—will become an everyday occurrence.

Whether rightly or not, President Obama, having come to power at the dawn of this crisis, will be blamed for it by over 50 percent of the population. He will be a one-term president. In response to his perceived socialization of America, there will be a swarm of secessionist and extremist activity, much of it violent. Militias and armed sects will be more prominent than in the early 1990s. Stand-off dramas, violent score-settlings, and going-out-with-a-bang attacks by laid-off workers and bankrupted investors—already a national plague—will become an everyday occurrence.

For both economic and social reasons, millions of immigrants and guest workers will return to their home countries, taking their assets and skills with them. The flow of skilled immigrants will slow to a trickle. Birth rates will plummet as families struggle with uncertainty and reduced (or no) income.

Property crime will explode as citizens bitter over their own shattered dreams attempt to comfort themselves by taking what is not theirs. Mutinies and desertions will proliferate in an increasingly demoralized, over-stretched military, especially when states can no longer provide the educational and other benefits promised to their National Guard troops.

There will be widespread tax collection issues, and a huge backlash against Federal and state bureaucrats who demand three-percent annual pay raises while private sector wages remain frozen or worse. In short, the “Tea Parties” of tomorrow will likely not be so restrained.

There will be widespread tax collection issues, and a huge backlash against Federal and state bureaucrats who demand three-percent annual pay raises while private sector wages remain frozen or worse. In short, the “Tea Parties” of tomorrow will likely not be so restrained.

Finally, between now and 2012, we are likely to see another earth-shaking national embarrassment on the scale of the 9/11 attacks or Hurricane Katrina and its aftermath. This will demonstrate conclusively to all Americans that their government, even under a savior-figure like Obama, cannot, in fact, save them.

By 2012, there will be a general feeling that the nation is in immediate danger of blowing up or coming apart at the seams. This fear will be justified, given that the U.S. has always been held together by the promise of a continuously rising material standard of living—the famous “pursuit of happiness”—rather than any ethnic or religious ties. If that goes, so could everything else. We were lucky in the 1930s—we may not be so lucky again.

Filed under: Predictions, The Meltdown | 120 Comments »

The headline above echoes a popular question asked by all who suddenly realize gold and silver prices have been manipulated on the COMEX. No less an authority than Jim Sinclair (of JSMineset.com) answered this query Monday, June 8, 2009:

The headline above echoes a popular question asked by all who suddenly realize gold and silver prices have been manipulated on the COMEX. No less an authority than Jim Sinclair (of JSMineset.com) answered this query Monday, June 8, 2009:

Prediction one.

Prediction one.

Prediction three.

Prediction three.

Prediction six.

Prediction six.

There will be widespread tax collection issues, and a huge backlash against Federal and state bureaucrats who demand three-percent annual pay raises while private sector wages remain frozen or worse. In short, the “Tea Parties” of tomorrow will likely not be so restrained.

There will be widespread tax collection issues, and a huge backlash against Federal and state bureaucrats who demand three-percent annual pay raises while private sector wages remain frozen or worse. In short, the “Tea Parties” of tomorrow will likely not be so restrained. Richard Maybury describes himself as “The 2,500-year old man,” referring to his deep study of history (economic & otherwise) and how it repeats today.

Richard Maybury describes himself as “The 2,500-year old man,” referring to his deep study of history (economic & otherwise) and how it repeats today.

Nostradamus code-named him “PAU, NAY, LORON.” All in uppercase. An obvious decoding would give us three towns in southwestern France: Pau, Nay and (O)loron. The rest of the prophecy strays the subject away from three villages to describe a human being. The upper-case presentation is a literary nudge in our sides to envisage a person’s name hidden in the letters spelling three towns.

Nostradamus code-named him “PAU, NAY, LORON.” All in uppercase. An obvious decoding would give us three towns in southwestern France: Pau, Nay and (O)loron. The rest of the prophecy strays the subject away from three villages to describe a human being. The upper-case presentation is a literary nudge in our sides to envisage a person’s name hidden in the letters spelling three towns. Nostradamus code-named the second Antichrist “Hiƒter” — or “Hister” with a Gothic “s” — after the ancient name of the River Danube, which is the Ister. Nostradamus spells it with its most arcane variant Hister as some specific hint. Again, there’s a pattern to follow here. This “Danube” finds itself a thing representing a person mentioned as Hister in five prophecies containing similar story lines.

Nostradamus code-named the second Antichrist “Hiƒter” — or “Hister” with a Gothic “s” — after the ancient name of the River Danube, which is the Ister. Nostradamus spells it with its most arcane variant Hister as some specific hint. Again, there’s a pattern to follow here. This “Danube” finds itself a thing representing a person mentioned as Hister in five prophecies containing similar story lines.  Though his true name is occulted, the Third Antichrist’s destiny is made clear. Unlike the first two, he is the first to die in a war he initiates at the sign of a comet, or a rocket falling out of the skies:

Though his true name is occulted, the Third Antichrist’s destiny is made clear. Unlike the first two, he is the first to die in a war he initiates at the sign of a comet, or a rocket falling out of the skies:

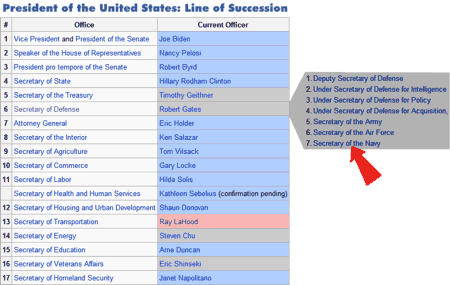

A previous Secretary of the Navy, James Forrestal, was likely murdered when he threatened to go public over the Roswell Incident against the wishes of his compatriots in Majestic 12 in May 1949. FYI the alleged alien captives sequestered in Area 51 are under the jurisdiction of ONI, Office of Naval Intelligence.

A previous Secretary of the Navy, James Forrestal, was likely murdered when he threatened to go public over the Roswell Incident against the wishes of his compatriots in Majestic 12 in May 1949. FYI the alleged alien captives sequestered in Area 51 are under the jurisdiction of ONI, Office of Naval Intelligence.

![[Most Recent USD from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent DJIA from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_djia_en_2.gif)