Here’s a good question from a reader, “Mike“:

Scott,

I have been following your website for some time along with Sinclair and enumerable others. I think you do a great job and I find your musings incredibly infromative. I’ve never traded futures on the comex but this whole comex cracking/failure to deliver thing puzzles me a great deal.

As best I can tell, if someone wanted to bust the comex couldn’t they just go long an unlimited amount of futures and then just ask for delivery?

The total dollar amount of all registered comex inventory is only about $3B which for many wealthy oligarchs, sovereign wealth funds, or potentially hostile countries is but a drop in the bucket. Is there something I’m missing here?

People seem to get excited about the comex potentially failing and it very well could but it seems that it wouldn’t be very difficult if anyone really wanted to. Again, perhaps I’m oversimplifying but I think getting a clear understanding is very important so people aren’t mislead in their understanding of the process and in any investment decisions regarding the precious metals skyrocketing if and when the comex collapses.

By the way, I am incredibly bullish on both monetary metals and am a firm believer in abolishing the fed, a return to sound money, etc., etc. etc. I’d love to hear your thoughts on this issue when you have a moment as it would probably be educational for me and many other of your readers.

Thanks so much and keep up the great work,

Mike

Mike, here’s my take on it FWIW:

Mike, here’s my take on it FWIW:

I agree, theoretically it shouldn’t be all that hard to crack COMEX open like a ripe melon. Like you say, it’s a relatively small market.

How small? As of yesterday, June 3, 2009, COMEX reported a total silver inventory of 120,879,235 oz. So, 121 million ounces at $15.92/oz works out to $1.9 billion.

[/begin conspiracy rant]

Chump change when the “govmint” is throwing around trillions. Geez, remember how the “govmint” gave JPMorgan $30 billion for taking over failing Bear Stearns? Monday, March 17, 2008 was the FIRST business day JPMorgan assumed and expanded Bear Stearns’ COMEX silver manipulation. [link] JP Morgan is almost solely responsible for the COMEX silver manipulation, and they’re funding it with money given to them by your “govmint”.

Oh, BTW, do you remember when silver hit its recent 28+ year high?

Monday, March 17, 2008, you say, the EXACT SAME DAY JPMorgan took over the COMEX silver manipulation from Bear Stearns? What a coincidence…the price has been beaten down visciously ever since.

[/end conspiracy rant]

So, yes, if you know someone who’s pro-freedom and anti-bankster with a spare $2 billion* they’d have a shot at getting it done.

But normally there’s a problem with doing something like this. You can’t just go out and BUY long futures contracts: there has to be someone else willing to take the other side and SELL short. The COT report (Commitment of Traders) tells us how much JP Morgan’s willing to bet on shorts: right now it sits at 235 million oz.

Yes, you read right. JPMorgan is short DOUBLE the entire COMEX silver stockpile. Guess it won’t be hard to find someone to take the other side of your long bet!

Yes, you read right. JPMorgan is short DOUBLE the entire COMEX silver stockpile. Guess it won’t be hard to find someone to take the other side of your long bet!

BUT WAIT! YES! Now you’re catching on! The very fact that there’s 235 million ounces SHORTED out there right now means SOMEONE(S) ALREADY MADE THE LONG BET as well.

Are you getting this? While you (and any normal, rational human who can fog a mirror) would think all you’d have to do to bust COMEX is make a long bet for the ENTIRE COMEX inventory, you’d be wrong. It’s been tried before AND IT’S BEING TRIED RIGHT NOW. But JPMorgan just keeps making a bigger SHORT bet.

How can they do that?

Ever play poker? Say you’ve got more chips than everyone else at the table. What the hey, let’s make that more than everyone else COMBINED at the table. Let’s also pretend you’re arrogant and cocky ‘cuz your rich uncle is standing behind you, ready to replenish your supply of chips. And, boy oh boy, is he loaded. (We’ll call him your good ol’ Uncle Sam.)

What happens when you’re dealt a crappy hand? Fold?

HAH!

Bluff your way to a winning hand, up the ante, RAISE, RAISE, RAISE. As long as you can outspend ’em all you got a shot at the pot.

You see, Mike, JPMorgan knows silver is going north like Santa on Dec 26th. Their silver hand absolutely sucks. But, our “govmint” gave ’em a $30 billion grubstake to keep a lid on silver. As long as silver is down, the dollar looks solid and the sheeple won’t panic. [See: JPMorgan Is Fed’s Fair-Haired Golden Boy]

You see, Mike, JPMorgan knows silver is going north like Santa on Dec 26th. Their silver hand absolutely sucks. But, our “govmint” gave ’em a $30 billion grubstake to keep a lid on silver. As long as silver is down, the dollar looks solid and the sheeple won’t panic. [See: JPMorgan Is Fed’s Fair-Haired Golden Boy]

And, so far, JPMorgan knows everyone holding a long position is NOT paid up; they’re LEVERAGED. If JPM can knock silver down a buck the longs’ll get whacked with a big margin call. If they can’t cover, they lose. When the whacked longs lose, their emergency exit pushes the silver price down some more. That causes more margin calls for the longs, pushing the price further down, et cetera, et cetera, et cetera, ad nauseum.

So far the longs (“us” not “U.S.”) have lost each time. But let me ask you this: can a guy win a poker championship with nothin’ but bad hands and solid bluffing?

Would you bet your retirement, your country, your currency, your very physical safety on the guy NEVER having his bluff called and winning EVERY time?

I, for one, want a place at the table when his luck runs out. That’s why I don’t trade my silver, why I have only bought silver since 2005, and why I never sell. I have all the silver I ever bought, except for that which I’ve given away to help people [If You Have No Silver I’ll Give You Some of Mine].

* So, can a guy step in and bust COMEX for $2 billion? Hmmm, sure, futures are leveraged so maybe you could do it for less. In an honest market (#snicker#) 1/10th of $2 billion oughta do it. BUT JPMorgan’s used those nasty margin calls to flush out the longs before. Guess you’d better have the full $2 billion to do it.

But wait! It ain’t enough to bet the entire COMEX stockpile long. Remember, JPMorgan’s betting DOUBLE the entire stockpile. If you wanna call ’em I guess you better pony up about $4 billion.

But wait, again! Who says JPMorgan won’t short even more? How MUCH could they short? $8 billion? $16 billion? Gee, wouldn’t the CFTC step in at some point and declare a manipulative short position and stop the madness?

NO.

[/begin conspiracy rant]

You see, the chairman of the CFTC sits on the president’s Plunge Protection Team [link]. He’s automatically in on the manipulation. If it makes him squeemish heading up a dishonest, deceptive “watchdog” organization he can just quit. Oh wait a minute. It does look like turnover’s been a problem at the CFTC Chairman position:

2005: Sharon Brown-Hruska

2006: Reuben Jeffery III

2007: Walt Lukken

2009: Michael V. Dunn

2009: Gary Gensler

Hmmm, maybe they do have a conscience. At least a small, easy-to-kick-around, Jiminy Cricket one.

[/end conspiracy rant]

So, NO, the crooked CFTC won’t stop JPMorgan’s silver manipulation, you see, because they’re backing it. So, if you’re going to bust COMEX you’d better have enough multi-billions on hand to call JPMorgan’s bluff. And, you’re not just going up against JPMorgan, but the guy who’s bankrolling them: dear ol’ Uncle Sam.

Maybe it’d be easier to replace CFTC leadership with an honest guy. Maybe you’d also have to replace at least 51 Senators. Maybe throw in 222 Congressman (you can keep Ron Paul, maybe Dennis Kucinich.)

Or, maybe you just wait for the US dollar to finally collapse. Once there’s no dollar to protect, there may be no reason to keep a lid on gold and silver. Actually, now that I think about it, since the Shadow Powers want a dollar collapse anyways (to cripple the U.S. and make way for greater global gov’t) maybe they already plan to trigger it by abruptly stopping the manipulation.

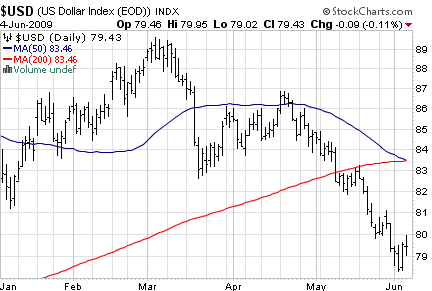

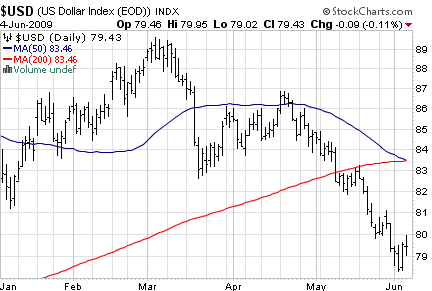

Hmmm… maybe the dollar dive has already started…

Have you noticed how nervous the Chinese have gotten in the past few weeks? How Brazil no longer uses the dollar for trade. How Russia now prices oil in rubles not dollars? How the Chinese laughed at Treasury Secretary Geithner last week when he said “the dollar’s strong.” [ Read Why The Chinese Laughed At Geithner by former Assistant Secretary of the Treasury Paul Roberts.]

And, finally, the last time COMEX had manipulated the silver price below its cost of production a couple brothers from Texas tried their hand at busting COMEX by going long on silver and preparing to TAKE PHYSICAL DELIVERY of 192 million ounces. What happened? The CFTC crooks villified them.

The Hunts shook the lying bankers to their boots – to the point where intervention by the Fed, Treasury, and the Defense Department were warranted – merely by asking for delivery of the 192 million ounces of silver they’d been promised. This was not a “cornering” of a market; it was the attempt to enforce a contract, same as you’ve got with your landlord or bank.

Read “The Hunts Tried to Corner the Silver Market” Myth.

Please protect yourself and your family. Don’t cash in your (gold and silver) insurance!

More:

COMEX Crimes: Your Tax $ at Work

JPMorgan Is Fed’s Fair-Haired Golden Boy

Filed under: > Scott's Soapbox, Silver & Gold, Vaporize COMEX CountDOWN | Tagged: Comex, silver manipulation, vaporize COMEX | 4 Comments »

Standard & Poor’s downgraded the creditworthiness of 22 18 banks [link] including:

Standard & Poor’s downgraded the creditworthiness of 22 18 banks [link] including:

Will Increased Delivery Demand Bust the Gold Warehouses?

Will Increased Delivery Demand Bust the Gold Warehouses?

![[Most Recent USD from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent DJIA from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_djia_en_2.gif)