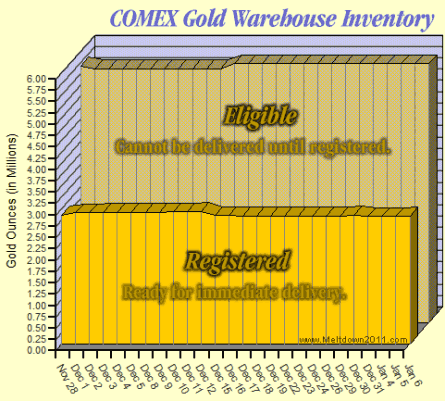

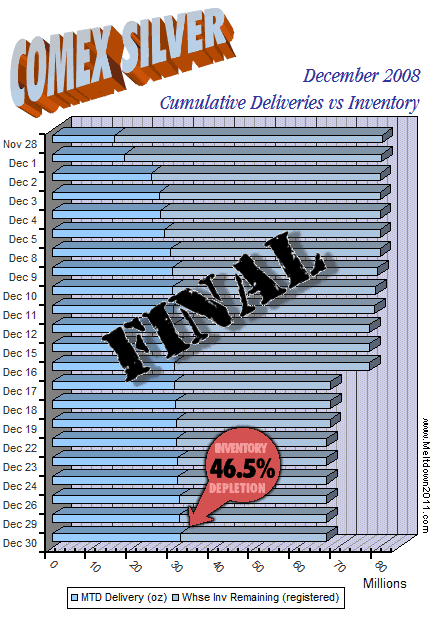

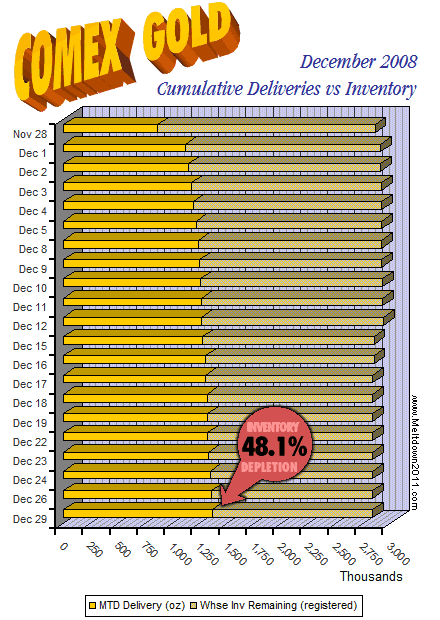

Since I started tracking COMEX gold and silver warehouse levels last November I’ve grown to be very suspicious of the numbers COMEX reports each day. In spite of increased physical deliveries in both metals, “registered” inventory levels remain more or less stable. This is why I gave up daily updates in favor of weekly ones; I just don’t have all that much faith in COMEX reporting.

Hero and venerable gold guru Jim Sinclair has experience in all things gold going back to the 1970s. Things happening NOW at COMEX gold warehouses are reminding him of severe delivery problems that bankrupted brokers BACK THEN.

Hero and venerable gold guru Jim Sinclair has experience in all things gold going back to the 1970s. Things happening NOW at COMEX gold warehouses are reminding him of severe delivery problems that bankrupted brokers BACK THEN.

Will Increased Delivery Demand Break The Gold Warehouses?

Dear Friends,

I have been speaking with many people this evening who have taken gold delivery.

What I am hearing is not impressive.

For decades warehouses have held, but rarely delivered as compared to store.

When examined closely it is a paper system that may have fallen badly behind as gold moved ahead since 2001.

There is a possibility the system is antiquated and more FUBAR than anyone, even the warehouses themselves, realize.

I have been told that bars delivered do not correspond with the receipts from exchanges.

I have been told that bars of slightly different weight (higher) have been received.

This may well be a system that has never been asked to handle volumes as are now taking place. This may well be like the old hand clearing equity systems that broke down as volume of trading increased in the early 70s.

This may well be a system that has never been asked to handle volumes as are now taking place. This may well be like the old hand clearing equity systems that broke down as volume of trading increased in the early 70s.

F.I. Dupont went out of business because their back office could not meet the growing clearing and trading at that firm.

Pershing, and Vilas & Hickey were the two largest equity clearing firms.

Vilas & Hickey, a NYSE firm of which I was a general partner (at 27 years old) recognized the growing problem and transferred our clearing business to Pershing and merged our activities into another firm, Muller & Company, in order to avoid the impending problem.

I was the sole general partner of the merged NYSE firm so I know what I talk about. We preserved our capital and side stepped a problem that busted many firms.

I smell exactly the same thing in the precious metals warehouse business. How pervasive it is we all will soon find out.

Regards,

Jim

And Jim’s friend J.B. Slear, who helps people out with getting physical delivery from COMEX, is reporting:

1) “We’re finding out that some brokerages will not help with the delivery process or refuse to help even after the commissions are paid.”

2) “Calls today are reflecting concerns about accounting practices in Canada and other G7 countries.”

3) “…We have witnessed cost increases in just about everything “Comex”, from Prudential’s verification process (which is matching buyers monies and sellers bars) all the way down the line to the delivery itself.”

Read more at Assistance Getting Delivery from COMEX Warehouses.

Filed under: Silver & Gold, Vaporize COMEX CountDOWN | Tagged: bust COMEX, COMEX default, COMEX delivery | 12 Comments »

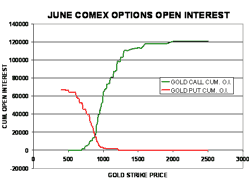

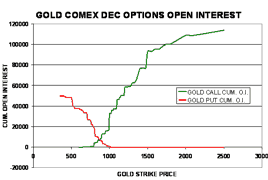

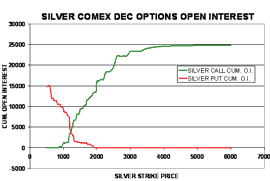

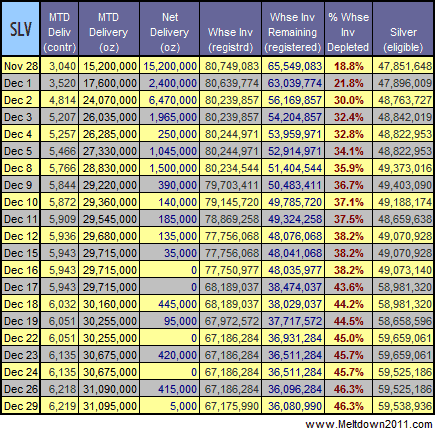

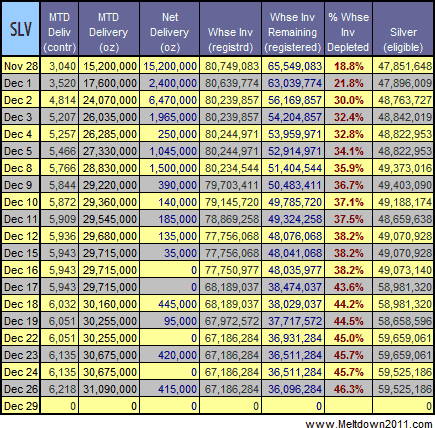

“What’s somewhat ironic is that there was a tremendous amount of discussion over the past few months about backwardation and potential delivery troubles in the past December contract. None of those threats came to fruition.

“What’s somewhat ironic is that there was a tremendous amount of discussion over the past few months about backwardation and potential delivery troubles in the past December contract. None of those threats came to fruition.

![[Most Recent USD from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent DJIA from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_djia_en_2.gif)