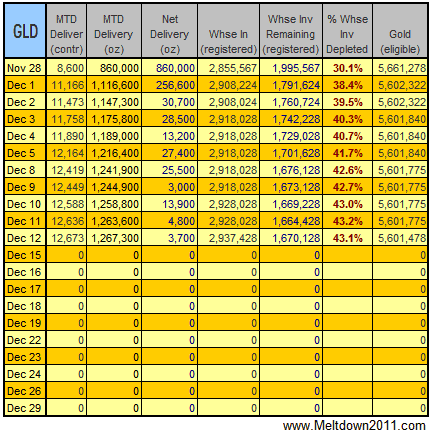

Last update: Fri 12/12/2008, 2:59 pm CST.

Gold: 43.1% depleted. Deliveries requested today: 3,700 oz.

Silver: 38.2% depleted. Deliveries requested today: 135,000 oz.

Link to all Vaporize COMEX posts:

Latest:

COMEX: Taking Delizery Is EZ

Silver Dealers: My Experiences

COMEX trades hundreds of times more gold & silver than they actually possess. If enough investors demand delivery of PHYSICAL gold & silver COMEX stockpiles will be depleted. If COMEX runs out, the ensuing rush to grab physical metal to settle contract obligations *could* be the spark that ignites the long-awaited precious metals wildfire.

Explanation:

COMEX warehouses contain both “registered” and “eligible” metals. The “registered” metals are available for physical delivery. The “eligible” metals are not ready for delivery until they become “registered.” Although this pool of “eligible” metals is stored at COMEX warehouses there is no obligation to “register” these metals for subsequent physical deliveries.

The graph shows:

1) the cumulative ounces of metal delivered this month,

2) the ounces of “registered” metal available for delivery,

The percentage shown is based on the cumulative physical metal deliveries for the month against the “registered” amount of metal in COMEX.

“Eligible” metal inventories are not shown as they do not have a direct bearing on the inventory depletion ratio.

Sources:

[1] COMEX precious metals warehouse stocks: http://www.nymex.com/warehouse.aspx

[2] COMEX precious metals daily deliveries: http://www.nymex.com/media/delivery.pdf

More info:

– Gold: Is This It, NOW?

– Attack of COMEX Gold & Silver

– How 2 Track COMEX Deliveries

– Sinclair Sez “Help Me Bust Comex”

– This Guy Plans 2 Kill “Paper” Silver

– COMEX: Taking Delizery Is EZ

Filed under: Vaporize COMEX CountDOWN | Tagged: COMEX default, vaporize COMEX |

![[Most Recent USD from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_usd_en_2.gif)

![[Most Recent DJIA from www.kitco.com]](https://i0.wp.com/www.weblinks247.com/indexes/idx24_djia_en_2.gif)

I wish this thing would default already!

Maybe the dollar crash (in progress) will trigger a rush of longs taking delivery. What we really need is Russia to step in and take delivery…that would be the final nail in the coffin of the paper shorts. Why aren’t Greenspan, Paulson, Bernake, and the rest of the crooks in jail?

It DOESNT MATTER whether there is physical “delivery” or not. All the longs need to do is corner the warehouse receipts so this is a moot point.

What MATTERS is the fact that the basis remains negative (aka gold in backwardation) and has been since Dec 2nd.

The question is not, “will the spec longs take delivery or not”, (though this is important), but rather what is more critical to ask and obverse is, “Will the situation of negative basis (backwardation) reverse or will it continue? “

Scratch that. They became visible once I posted the previous comment. Weird.

Not sure why, but I can no longer see your charts.

What’s happened ?

Listen to this week’s Financial Sense 12/13/08 – http://www.financialsense.com/fsn/main.html at 0:55:00 – Dave Morgan says that most of the notices to deliver never get delivered on.

–joe

Comex said warning brokers about December gold squeeze

Submitted by cpowell on Sat, 2008-12-13 04:11. Section: Daily Dispatches

From “Midas” Commentary

by Bill Murphy

LeMetropoleCafe.com

Friday, December 12, 2008

I received a call this morning from a commodities broker who told me that the Comex is alerting various futures firms about the potential of a squeeze on the December contract and is advising the $840 December shorts to exit their positions. That is the remaining open position.

There have been 12,636 notices of delivery. The shorts have until December 31 to make delivery. Normally they deliver early to take in cash and earn the interest. They must be delaying. As I understand the situation, that represents about 40 percent of the gold available at the Comex, and of course someone could enter the scene late, buy February gold, and then spread into December, which would stun the shorts.

My broker friend said his back office said this sort of alert is highly unusual and that the concern is real, not only for gold, but for other commodities too, like copper and palladium, as there is a good deal of talk of taking deliveries there too. But gold is the one for which the advice to cover went out.

This is an extremely productive development and could spur the price of gold up quickly as word spreads. As we all know, buying Comex gold and silver (the cheapest way to buy precious metals) makes all the sense in the world in this financial environment.

Comex said warning brokers about December gold squeeze

Submitted by cpowell on Sat, 2008-12-13 04:11. Section: Daily Dispatches

From “Midas” Commentary

by Bill Murphy

LeMetropoleCafe.com

Friday, December 12, 2008

I received a call this morning from a commodities broker who told me that the Comex is alerting various futures firms about the potential of a squeeze on the December contract and is advising the $840 December shorts to exit their positions. That is the remaining open position.

There have been 12,636 notices of delivery. The shorts have until December 31 to make delivery. Normally they deliver early to take in cash and earn the interest. They must be delaying. As I understand the situation, that represents about 40 percent of the gold available at the Comex, and of course someone could enter the scene late, buy February gold, and then spread into December, which would stun the shorts.

My broker friend said his back office said this sort of alert is highly unusual and that the concern is real, not only for gold, but for other commodities too, like copper and palladium, as there is a good deal of talk of taking deliveries there too. But gold is the one for which the advice to cover went out.

This is an extremely productive development and could spur the price of gold up quickly as word spreads. As we all know, buying Comex gold and silver (the cheapest way to buy precious metals) makes all the sense in the world in this financial environment.

thanks for making an opaque subject easier on the eyes and mind.

Gold basis remains negative (in backwardation)

COMEX U FAIL

Jay:

An astute observation, and quite true as well. Thanks for reading!

The inventory numbers are probably going down because deliveries are actually being taken. I’m not sure the percentages-of-current-inventory values are correct, since it might be true that 2 million of the 30 million silver ounces have already been delivered and withdrawn from the warehouse…